Hsmb Advisory Llc - Truths

Wiki Article

Little Known Facts About Hsmb Advisory Llc.

Table of ContentsThe 15-Second Trick For Hsmb Advisory LlcIndicators on Hsmb Advisory Llc You Should Know7 Simple Techniques For Hsmb Advisory LlcThe Single Strategy To Use For Hsmb Advisory Llc

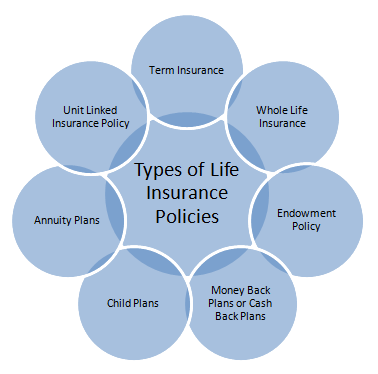

Life insurance policy is specifically crucial if your family is reliant on your income. Sector experts suggest a plan that pays out 10 times your annual income. These may consist of home loan payments, superior car loans, credit report card debt, tax obligations, child care, and future college expenses.Bureau of Labor Statistics, both partners functioned and brought in income in 48. 9% of married-couple family members in 2022. This is up from 46. 8% in 2021. They would certainly be most likely to experience financial hardship as an outcome of one of their breadwinner' fatalities. Health and wellness insurance can be obtained through your employer, the federal medical insurance market, or personal insurance coverage you purchase for on your own and your household by getting in touch with medical insurance business straight or undergoing a wellness insurance representative.

2% of the American populace lacked insurance policy coverage in 2021, the Centers for Disease Control (CDC) reported in its National Facility for Wellness Statistics. More than 60% got their coverage with a company or in the exclusive insurance industry while the rest were covered by government-subsidized programs consisting of Medicare and Medicaid, experts' benefits programs, and the government industry established under the Affordable Treatment Act.

A Biased View of Hsmb Advisory Llc

If your revenue is low, you may be one of the 80 million Americans that are qualified for Medicaid.According to the Social Security Administration, one in 4 employees getting in the workforce will come to be impaired prior to they reach the age of retired life. While health insurance coverage pays for hospitalization and medical expenses, you are frequently strained with all of the costs that your income had actually covered.

Several policies pay 40% to 70% of your revenue. The expense of disability insurance coverage is based on many elements, including age, lifestyle, and health.

Prior to you acquire, read the small print. Many plans require a three-month waiting period before the protection kicks in, supply a maximum of 3 years' worth of insurance coverage, and have significant plan exemptions. In spite of years of improvements in car security, an estimated 31,785 people passed away in web traffic crashes on united state

Indicators on Hsmb Advisory Llc You Should Know

Comprehensive insurance covers burglary and damage to your car due to floods, hail, fire, criminal damage, falling things, and pet strikes. When you fund your automobile or lease a car, this sort of insurance coverage is required. Uninsured/underinsured motorist (UM) insurance coverage: If an uninsured or underinsured motorist strikes your automobile, this coverage pays for you and your traveler's clinical costs and might additionally make up lost revenue or make up for discomfort and suffering.

Employer insurance coverage is often the very best choice, however if that is unavailable, obtain quotes from numerous providers as many supply price cuts if you purchase even more than one type of protection. (http://dugoutmugs01.unblog.fr/2024/02/26/health-insurance-st-petersburg-fl-your-guide-to-protection/)

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

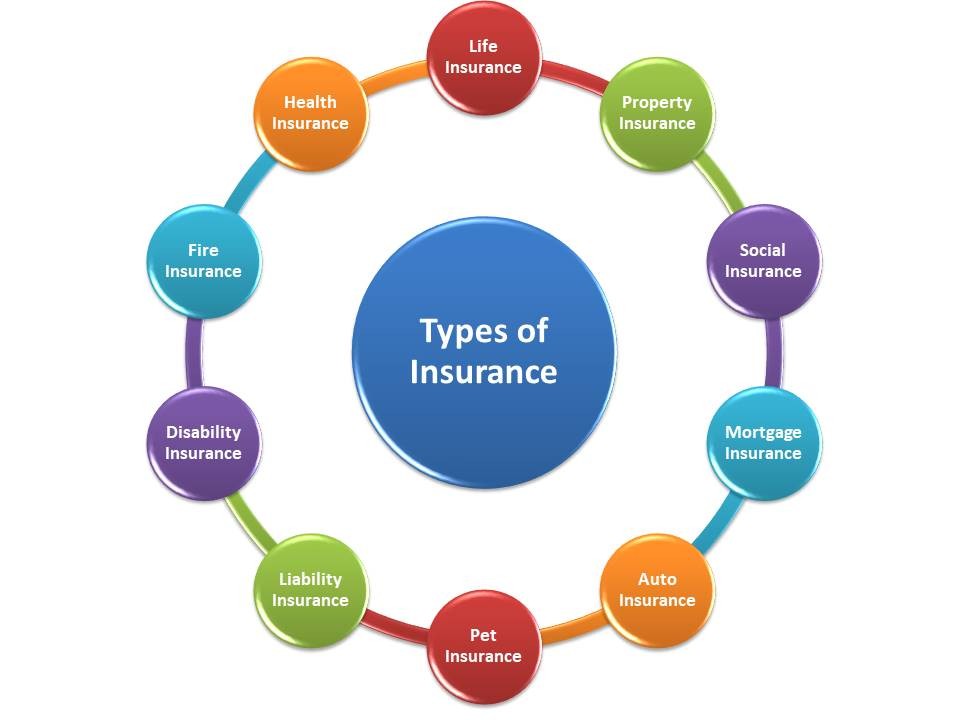

In between health and wellness insurance policy, life insurance policy, handicap, obligation, lasting, and even laptop insurance coverage, the task of covering yourselfand thinking of the endless opportunities of what can happen in lifecan feel overwhelming. Once you recognize the fundamentals and make certain you're effectively covered, insurance policy can enhance monetary self-confidence and well-being. Right here are the most important kinds of insurance coverage you require and what they do, plus a couple ideas to stay clear of overinsuring.Various states have different laws, however you can anticipate medical insurance (which many individuals obtain via their employer), car insurance policy (if you possess or drive a vehicle), and house owners insurance coverage (if you own residential or commercial property) to be on the checklist (https://www.cheaperseeker.com/u/hsmbadvisory). Obligatory sorts of insurance coverage can transform, so inspect up on the most recent legislations every so often, especially prior to you restore check that your policies

Report this wiki page